Introduction

As climate change becomes a growing global priority, more and more companies and individuals are looking to understand the price of carbon credits to offset their carbon footprints to reach net zero. Carbon credits have gained significant momentum in recent years, with thousands of governments, businesses, and individuals investing in them to reduce their carbon footprint. In 2021 alone, the market was worth $2 billion.

But first, what are carbon credits? Carbon credits are a market-based approach to incentivize businesses and individuals to offset their own carbon emissions by investing in other carbon reduction projects.

This article will explore the history, price of carbon credits, their benefits and challenges and, more broadly, their impact on businesses and the environment. We’ll also answer commonly asked questions about carbon credits and explore successful carbon offsetting and pricing schemes in different industries and regions.

Key Objectives

🔍 Explain why organizations buy carbon credits for carbon offsetting

🔍 Understand the price of carbon credits

🔍 Explore the impact of carbon pricing on businesses and the environment

🔍 Discuss the different “types” of carbon credits and their varying standards

🔍 Address the concerns and criticisms of the carbon credit market

🔍 Answer frequently asked questions about carbon credits

🔍 Provide options to offset your carbon footprint and buy carbon credits with Thallo

What Is A Carbon Credit and Why Do Brands and Companies Buy Them?

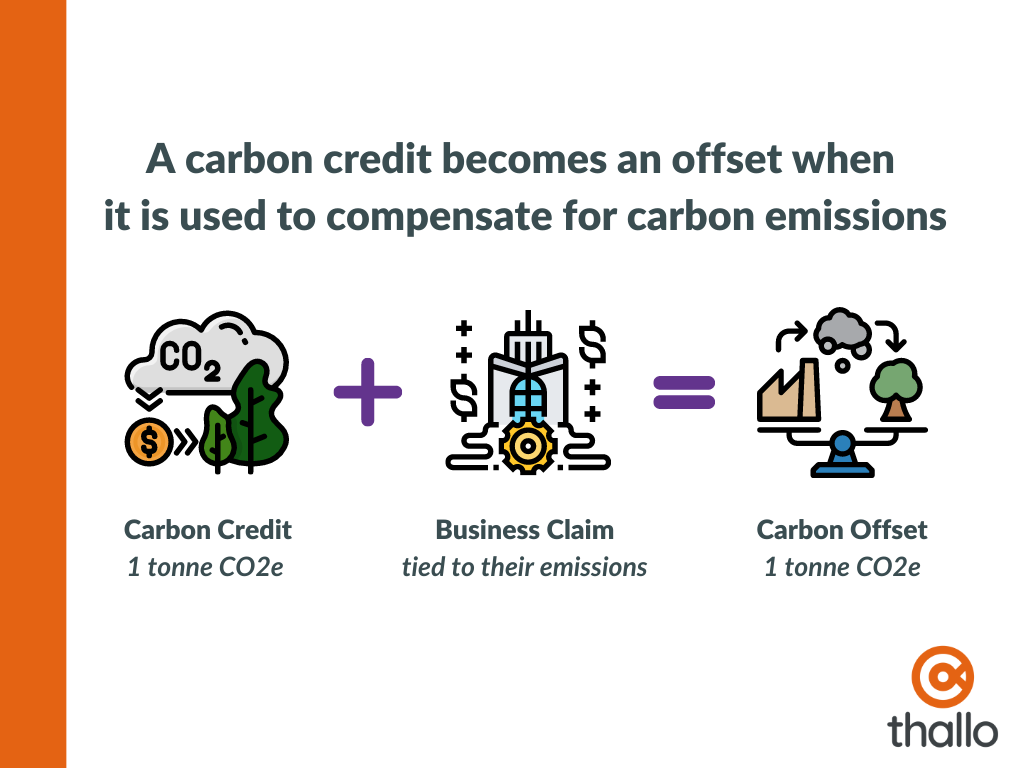

“Carbon credits” and “carbon offsets” are often used interchangeably, which can be confusing. They both refer to one tonne of carbon emissions that has been removed or kept from entering the atmosphere. A carbon credit becomes an offset when it is used to compensate for carbon emissions. A brief definition of these terms is outlined below:

▪️Carbon credit: A unit of account that represents one tonne of carbon either removed from the atmosphere (e.g. planting a tree that absorbs carbon dioxide) or kept from entering the atmosphere (e.g. protecting a tree that otherwise would be cut down and release its carbon into the atmosphere).

▪️Carbon offset: Typically used to refer to carbon credits that are being used to compensate for the carbon emissions that come from an organization or individual. The claim of a carbon offset can only be made once a carbon credit has been “retired” – which means it has been used up and cannot be resold or reused.

Once a buyer purchases a carbon credit, they must then take a second step in order to claim it as an offset. The buyer must “retire” the credit, which means it cannot be resold or reused.

As you can see, all carbon offsets are carbon credits, but not all carbon credits are carbon offsets.

In the business world, carbon credits and carbon offsets serve as environmental currency. Imagine a company’s carbon emissions as a debt to the Earth, a debt that accrues interest in climate change. To repay this debt, companies purchase carbon credits or offsets, much like making a payment on a loan. This process is a crucial part of their environmental and sustainability responsibility, helping to balance the ecological books by funding projects that reduce greenhouse gas emissions elsewhere.

There are two main markets where these transactions occur: the voluntary carbon market (VCM) and the compliance carbon market. The voluntary market can almost be seen as a charitable donation, where companies choose to offset their emissions out of a sense of corporate social responsibility. On the other hand, the compliance market is akin to paying taxes, where companies are legally required to offset a certain amount of their emissions under environmental regulations.

Now we know the voluntary and compliance markets, we can make one important distinction between carbon credits and offsets. Carbon credits can refer to units traded in either the voluntary or compliance markets. But if we’re talking about offsets, we know we are talking about the voluntary carbon market.

Regarding the value of carbon traded, the compliance carbon market is significantly larger than the voluntary one. The latest data to hand, from 2021, suggests the value of the compliance to be US $850 billion, of which 90% is in the European Union Emissions Trading Scheme (EU ETS). This is compared to the US $2 billion for the voluntary carbon market. This was two years ago, and values have increased for both. However, as the VCM is driven by companies that offset their emissions outside of legal requirements, it will likely remain much smaller than the compliance carbon market for a considerable time – though most agree that the voluntary carbon market will reach at least $10 billion by 2030, and perhaps as much US $550 billion by 2050.

It is worth noting at this point that Thallo only trades in the voluntary carbon market so we will only refer to that side of things in the remainder of this article. Also, to make things easier, we will use the terms “carbon offsets” and “carbon credits” interchangeably.

As we delve deeper into this topic, we will explore the intricate dynamics of carbon pricing. Much like the fluctuating prices in a stock market, the cost of carbon credits is influenced by various factors, which we will unpack in the following sections. This understanding will provide a comprehensive view of the economic landscape of carbon credits and offsets, highlighting the financial side of our collective effort to combat climate change.

A Brief History of the Carbon Market

The concept of carbon credits originated from the United Nations Framework Convention on Climate Change (UNFCCC) in 1992. The UNFCCC was established to address global climate change and set targets for reducing greenhouse gas emissions. The Kyoto Protocol, adopted in 1997, established the first legally binding targets for reducing greenhouse gas emissions in industrialised countries.

Under the Kyoto Protocol, countries were given a target for reducing their greenhouse gas emissions. Those that exceeded their targets could buy carbon credits from other countries that had reduced their emissions below their targets. This system allowed countries to meet their emissions targets more efficiently by purchasing carbon credits from countries that had already reduced their emissions.

The carbon credit market began to expand rapidly in the mid-2000s, with the introduction of the Clean Development Mechanism (CDM) and Joint Implementation (JI) under the Kyoto Protocol. The CDM allowed developing countries to earn carbon credits by implementing clean energy and other carbon reduction projects, which could then be sold to developed countries. JI allowed developed countries to earn carbon credits by investing in clean energy and other carbon reduction projects in other developed countries.

Since the end of the Kyoto Protocol in 2012, the carbon credit market has continued to grow and evolve. Today, there are several carbon credits standards and guidelines which we’ll address later.

The carbon credit markets today are a multi-billion dollar industry, with businesses and individuals investing in carbon credits to offset their emissions and reduce their carbon footprint. The market is expected to grow as more countries and businesses commit to reducing their greenhouse gas emissions to combat climate change.

How Carbon Credits are Priced, Bought, and Sold

The price of carbon credits in the voluntary carbon market can range from around one dollar to several hundreds of dollars per tonne of carbon dioxide equivalent (CO2e).

Carbon credits are unsurprisingly priced based on supply and demand, with prices varying depending on the “quality” of the carbon credit (which is often subjective) and the market in which it is traded. This is of course affected by the volume of carbon credits available in the market, and the demand for carbon credits from businesses and individuals looking to offset their emissions. The price of carbon credits is also affected by market intermediaries – Thallo research found that investors and brokers made up one-third of the average credit price in 2021.

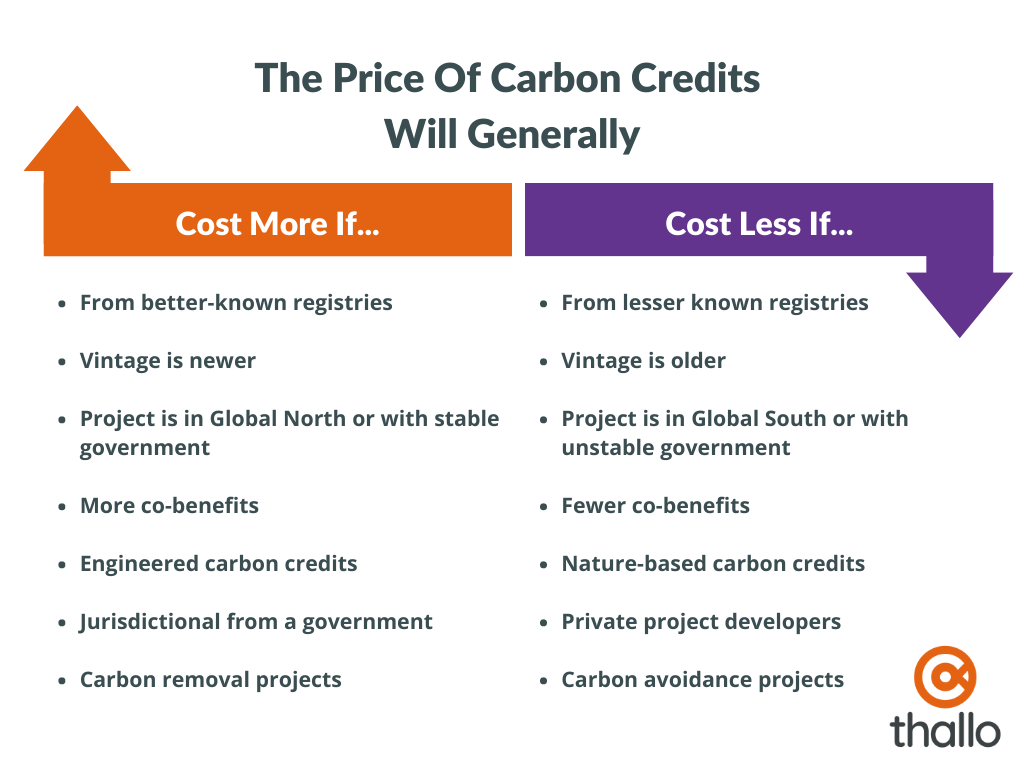

Beyond these normal market dynamics, however, the price of carbon credits is influenced by several factors, including:

▪️ Which standard issued the credits: better-known, established standards (e.g. Verra, Gold Standard, American Carbon Registry, Climate Action Reserve) tend to command higher prices over lesser-known, newer standards

▪️ Project methodology, or type: prices vary widely by methodology (e.g. afforestation, clean cookstoves, biochar, etc.), with renewable energy credits priced lowest, and engineered carbon credits priced highest

▪️ Vintage, or year the credits were issued: generally, the newer the vintage, the higher the credit price

▪️ Country or region where the project is located: credits from the Global North and from countries with stable governments tend to cost more than those in the Global South or countries with unstable governments

▪️ Additional co-benefits beyond carbon: generally, the more co-benefits (such as positively affecting a community or biodiversity, measured in the form of Sustainable Development Goals), the higher the price of the carbon credit

▪️ Whether it is nature-based or engineered: generally engineered carbon credits cost more than nature based, since they are newer and therefore the cost curves have not come down yet

▪️ Whether it is jurisdictional or project-based: generally, jurisdictional credits (from a government) tend to be higher priced than those generated by private project developers, though there are few jurisdictional credits on the market

▪️ Whether it is a carbon removal or carbon avoidance project: carbon removal projects usually command a price premium over carbon avoidance projects

▪️ Other factors, such as ratings by external ratings agencies or recent news stories: negative news coverage of specific projects tends to depress the prices for that specific project, poor ratings likely have a similar effect, though the carbon rating sector is new and not yet widely consulted

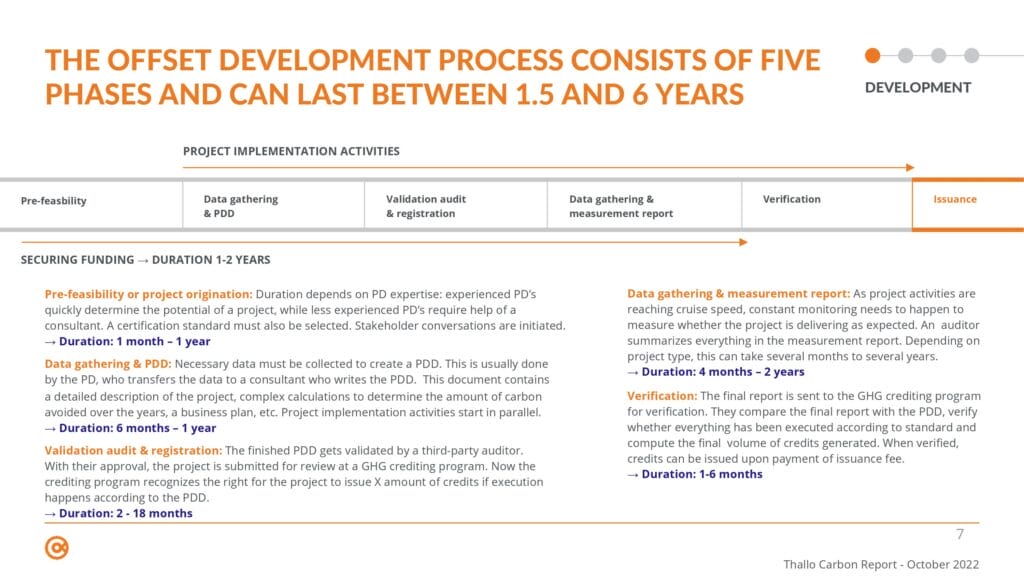

For project developers – who supply carbon credits to the market – getting to the point of sale involves several steps. First, they must register the carbon credit project, then get the emission reductions verified, and finally receive the carbon credits issued by a registry. Independent third-party verifiers oversee the entire process to ensure the integrity and accuracy of the carbon credit.

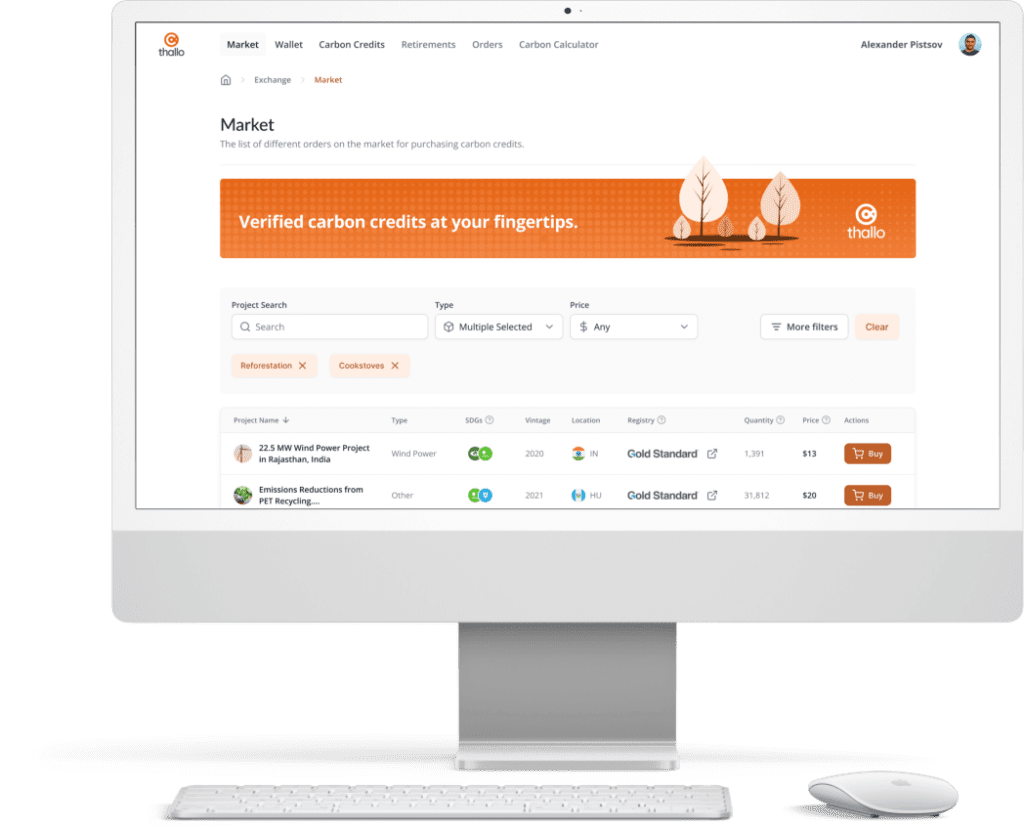

For buyers seeking to purchase carbon credits, the first step is to determine your brand’s carbon footprint, which can be done through a consultant or carbon accounting software. Once you’ve quantified your carbon emissions, you can choose the type and number of carbon credits you wish to purchase based on this footprint and your budget. This is where it can be a little time consuming when trying to sift through all the offerings that the projects have. Our Definitive Buyer’s Guide to Carbon Credits helps demystify this step.

Thallo aims to simplify this process, as we aggregate all of the different projects in a way that is easy to filter based on your key criteria. Almost like the “Amazon of Carbon Credits”!

The purchase process is typically straightforward and involves payment and receiving some kind of confirmation or certificate of purchase. After the purchase, it’s important to communicate this commitment to sustainability to your stakeholders, reinforcing your brand’s dedication to environmental responsibility.

Overall, the carbon credit market provides a valuable tool for businesses and individuals to reduce their carbon footprint, ideally to net zero and even beyond and help combat climate change. However, the market is not without its challenges, including concerns about the quality and effectiveness of carbon credits and the potential for carbon offsetting to be a form of greenwashing. In the next section, we’ll explore the role of carbon credits in reducing greenhouse gas emissions and the importance of offsetting carbon emissions.

The Role of Carbon Credits in Reducing Greenhouse Gas Emissions

Carbon credits are critical in reducing greenhouse gas emissions by incentivizing businesses and individuals to invest in carbon reduction projects. These projects can take many forms, including renewable energy, reforestation, and carbon capture and storage. As described above, these projects’ greenhouse gas emissions reductions are verified and quantified, and the corresponding carbon credits are issued.

While carbon credits are essential for reducing greenhouse gas emissions, they are not a panacea for climate change. The focus should always be on reducing emissions directly through energy efficiency, renewable energy, and sustainable practices. Carbon credits should be considered complementary to these measures rather than a substitute. However, recent research across 4,000 companies shows that companies buying carbon credits actually reduce their emissions twice as quickly as those that do not – a strong argument against concerns about greenwashing.

In the next section, we’ll explore the different carbon credit standards, such as Gold Standard, and how they can be used by businesses and individuals to reduce their carbon footprint.

“Types” of Carbon Credits and Their Standards

Ultimately a carbon credit is a metric tonne of carbon, or its equivalent (CO2e) in greenhouse gases (GHG). However, as described above, there are many different standards that verify and issue carbon credits (also referred to as ‘greenhouse gas crediting protocols’ or ‘registries’). These include Gold Standard, Verra, American Carbon Registry, Climate Action Reserve, BioCarbon Registry, Social Carbon, Plan Vivo, Puro.earth, and more, with new standards cropping up regularly. Buyers rely on these standards to ensure the credibility, transparency, and overall effectiveness of carbon offset projects.

These standards consider trustworthiness, sustainability, transparency, avoidance of double counting and other factors before they are verified. These standards serve to create a reliable and effective marketplace for carbon credits, fostering trust among buyers, sellers, and the public, while also ensuring the environmental integrity of carbon offset projects.

Gold Standard, for example, is a widely recognized standard for carbon credits that sets strict criteria for emissions reductions and sustainable development. Projects that meet their standard are verified to a high level of credibility and integrity, making them highly sought after in the carbon market.

Under each standard is a wide variety of different methodologies, such as biochar, clean cookstoves, direct air capture, renewables energy, afforestation/reforestation, etc.

You can think of the standards as brands that serve ice cream, and the methodologies as different flavors of ice cream. While chocolate ice cream from Ben & Jerry’s and Häagen-Dazs may have different recipes, you generally know what you’re going to get. Similarly, a REDD+ credit issued by Verra and a REDD+ credit issued by BioCarbon Registry are likely extremely similar in terms of the methodology.

The different types of carbon credits and their standards provide a range of options for businesses and individuals to choose from, depending on their specific needs and priorities.

Challenges Facing the Carbon Market

While carbon credits provide a valuable tool for reducing greenhouse gas emissions and supporting the development of carbon reduction projects, concerns and criticisms exist around their use. One of the main concerns is the potential for carbon offsetting as a form of greenwashing. Businesses or individuals purchase carbon credits to offset their emissions without making meaningful efforts to reduce them directly.

Another concern is the potential for carbon leakage, where businesses relocate to countries without carbon pricing policies to avoid costs. This can increase greenhouse gas emissions in those countries, offsetting the emissions reductions achieved through carbon offsetting.

There are also concerns about the credibility of some carbon credits and the lack of transparency in the carbon credit market. Using different types of standards can make it difficult for businesses and individuals to understand the true impact of their carbon-offsetting efforts.

Despite these concerns and criticisms, using carbon credits remains an essential tool for achieving net zero and supporting the development of carbon reduction projects. Carbon credits can incentivize businesses and individuals to invest in carbon reduction projects and provide financial support. And as noted above, companies that purchase carbon credits actually decarbonize their own operations twice as fast as companies that don’t.

Ultimately using carbon credits is only one tool in the toolbox to address the causes of greenhouse gas emissions and climate change. To truly address these issues, businesses and individuals must also take direct action to reduce their carbon emissions through investments in renewable energy, energy efficiency, and other low-carbon technologies and practices.

Carbon credits, however, allow businesses and individuals to take responsibility for their carbon emissions and support the development of carbon reduction projects. This can help offset their activities’ environmental impact and contribute to the fight against climate change.

Quick Q And A

What is one carbon credit equivalent to?

One carbon credit or carbon offset is equal to one metric tonne of CO2.

What is the current price of carbon credits?

The current price of carbon credits varies depending on the market and the type of carbon credit as explained above, and can range from around one dollar for a renewable energy credit up to several hundred dollars for a direct air capture project.

A good way to get a sense of carbon credit reference price and carbon credit price trends is to look at the price of CBL’s N-GEO contract, which represents agriculture, forestry and other land use (AFOLU) credits from the Verra registry. As of June 2023, the price was around $1.50, down from $13 at this time last year. This is likely due to extremely negative press coverage of the Verra nature based methodologies in recent months.

Do countries buy carbon credits?

Yes. Countries can buy carbon credits as part of their efforts to meet emissions reduction targets under the Paris Agreement.

How many trees does it take to offset one tonne of CO2?

The number of trees needed to offset one tonne of CO2 varies depending on the type of tree, its age, size, and other factors. A general rule of thumb is that a typical tree will sequester about 1 tonne of carbon in its lifetime.

Conclusion

In conclusion, the price of carbon credits is a complex and evolving topic with important implications for businesses, individuals, and the environment. While using carbon credits provides a valuable tool for reducing greenhouse gas emissions and supporting the development of carbon reduction projects, it is not without its challenges.

Businesses and individuals must approach carbon offsetting thoughtfully and ensure they make meaningful efforts to directly reduce carbon emissions. In addition, the carbon credit market must be transparent and credible, with clear standards for the types of carbon credits that can be used for carbon offsetting.

As the world continues to grapple with the challenges of climate change, using carbon credits and other carbon pricing policies will likely play an increasingly important role in reducing greenhouse gas emissions and supporting the transition to a low-carbon economy. It is up to businesses, individuals, and policymakers to ensure that the price of carbon credits is set at a level that incentivizes meaningful action on climate change while promoting economic growth and development.