One of the biggest challenges to scaling the voluntary carbon market (VCM) is its lack of transparency. The lack of transparency has much to do with the absence of regulation, as well as existing institutions and mechanisms that were not designed to harness the growing demand seen for carbon credits in recent years.

This challenge has left the VCM struggling to perform the core functions of an efficient market: facilitating market competition and directing capital toward the most impactful projects. It has also reduced trust, particularly among demand-side participants, thereby constraining positive climate impact.

This blog aims to summarize some of the key issues around transparency and highlight solutions that can immediately be deployed to forward-thinking market participants. Some of these can be addressed using a software-driven approach, such as Thallo’s, while others will require coordination from multiple stakeholders in the voluntary carbon market ecosystem.

To begin, a helpful way to think about transparency is to think about supply-side versus demand-side transparency.

Supply-side transparency focuses on the processes and structures projects undergo for monitoring, reporting and verification – as well as the clarity of information from the side of the carbon credit suppliers and registries.

Demand-side transparency is about ensuring that buyers have all the necessary information and tools to maximize impact, and make robust and credible environmental claims.

Although these can overlap, this blog focuses on the demand-side transparency. A discussion on supply-side transparency will follow.

Key challenges

Challenge 1: Project-level information

To help corporations navigate the market and maximize impact for every dollar spent, a key element of demand-side transparency is accessible and clear information about the carbon credits available. This includes details such as the issuing entity, the type of carbon reduction or sequestration activity involved, their location, associated co-benefits and the longevity and permanence of the carbon reduction.

Typically, without the support of service providers, this information is either not readily available, or it is stored in complex and indigestible project-level documents stored within the registries (a typical project may have hundreds of pages worth of documentation).

Challenge 2: Pricing and origin

Demand-side clarity must involve transparency in pricing mechanisms and the origin of the credits. Buyers should be able to understand how prices are set and be assured that their purchase is supporting legitimate and effective carbon reduction projects. Ideally, they should also be purchasing directly from the project owners on the ground – with as little intermediation as possible.

Greater transparency will give buyers more comfort in knowing that their money is going directly to the project owners on the ground rather than the patchwork of intermediaries who currently dominate the market.

Challenge 3: Regulation & standards

For many buyers, it is crucial to understand how purchasing carbon credits aligns with local, national, or international regulatory frameworks – as well as voluntary standards (such as the SBTI). For example, a company making product-level claims (e.g. carbon neutral water bottles) will need to be aware of the EU’s Empowering Consumers Directive, which will prohibit ‘misleading’ climate claims that are based on carbon offsetting. They might also need to have all of the information required to comply with California Assembly Bill 1305, which mandates enhanced disclosure requirements for companies purchasing, using, or selling voluntary carbon offsets within the state.

Currently, there are few tools to help companies navigate this emerging complexity. As the market matures though, it’s obvious that compliance with standards and regulations must go hand-in-hand with market transparency.

Challenge 4: Auditability & proof-of-provenance

Demand-side transparency also means having a traceable audit trail on every environmental claim. Currently, it’s estimated that 30-50% of all retirements on the major registries are done anonymously. Many are also done by intermediaries on behalf of their customers. That means that a huge proportion of the financing that goes through the VCM is difficult to map against associated environmental claims.

Having a publically accessible registry is fundamental – but not enough. Greater integrity will only be possible when each environmental claim—no matter how small—has a bullet-proof audit trail and can be mapped against an associated credit retirement. This level of detail is crucial for verifying the authenticity of credits and ensuring they are sourced responsibly and effectively.

Challenge 5: Lack of standardization

Transparency also relates to the clarity of information presented. There is no value in having publicly accessible data if it is unintelligible to the average stakeholder. By way of example, the largest registry, Verra, has over 200 different methodologies that an ambitious buyer might need to wrestle with. Thus, the market gives more space to ‘expert’ intermediaries who are required to translate complexity into layman’s terms – with less financing going to projects on the ground.

Greater standardization would make it simpler for buyers to compare and evaluate different carbon credits, fostering a more competitive and trustworthy market. Standardized information can therefore go a long way in supporting corporations, particularly those without large sustainability teams, to make sense of an otherwise hugely complex market.

Challenge 6: Reporting

Transparency is intrinsically linked with reporting. That said, because the market is voluntary, without one recognized and centralized rule-setting entity, there are a plethora of reporting standards and best practices. This fragments the market and makes it difficult to differentiate between a robust environmental claim and greenwashing. It also adds complexity and risk for forward-thinking and ambitious companies.

Even for the most ambitious demand-side corporation, navigating between the Voluntary Carbon Markets Integrity Initiative’s Code of Practice (VCMI), the Science Based Targets Initiative’s Guidance, and the Oxford Principles on Carbon Offsetting is no simple task – and may inhibit ambition. Adopting a uniform method of reporting across the market can therefore significantly enhance transparency and build integrity in the market.

Achieving demand-side transparency through a software driven approach

Addressing all of the aforementioned challenges is a monumental challenge. It requires concerted and coordinated efforts from all stakeholders across the market.

Great progress on market transparency is currently being spearheaded by standard setters (e.g. the VCMI), data providers (carbon rating agencies such as BeZero), as well as other infrastructure players (such as the World Bank’s Climate Action Trust).

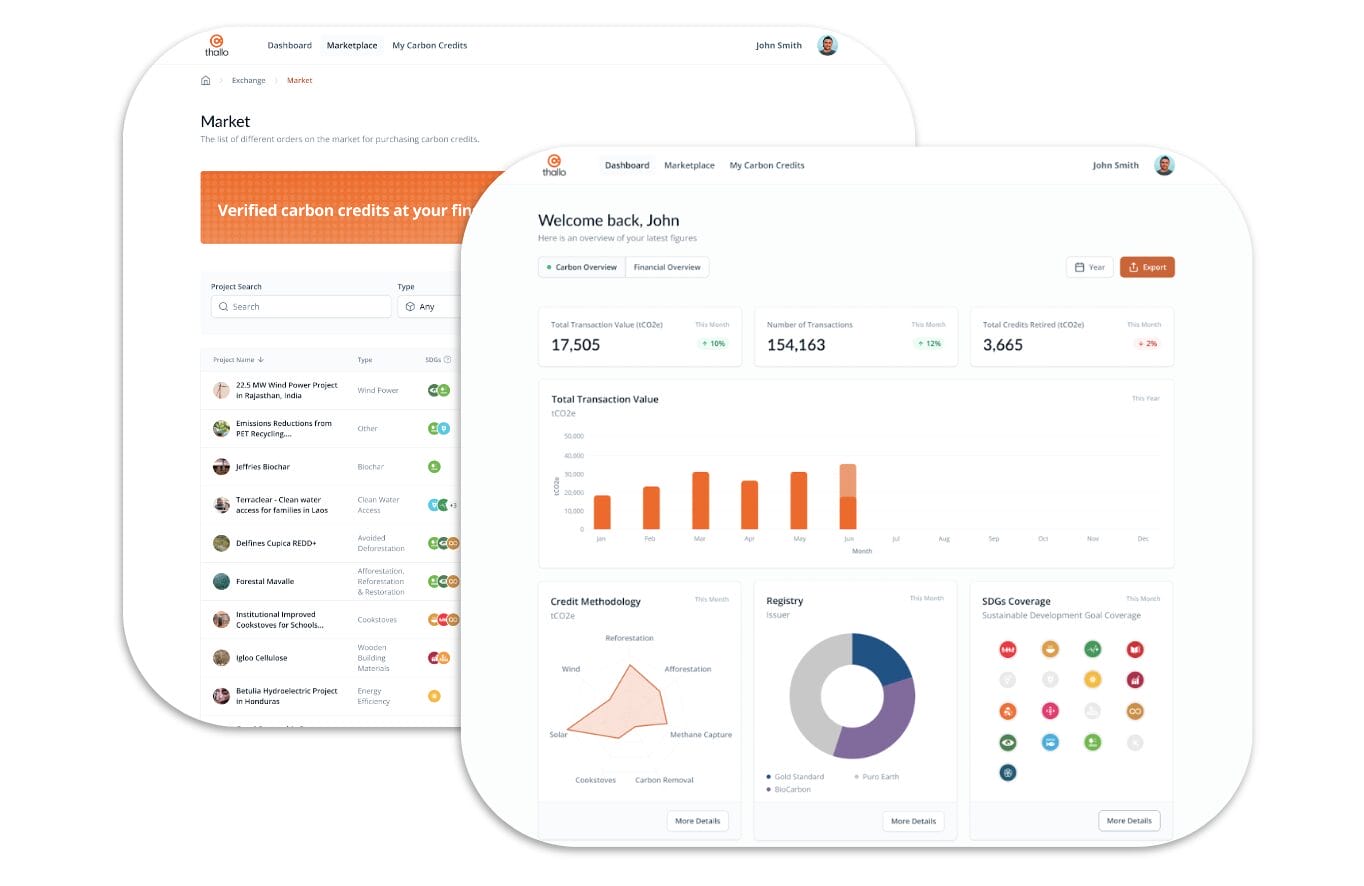

As has been seen in other markets, software can play a key role in making the market more accessible, efficient, and impactful. In the remainder of this blog, we’ll showcase how Thallo’s software-driven approach can contribute to these challenges.

Empowering businesses to comply with regulations

Digital infrastructure simplifies compliance by providing readily available documentation and data to support disclosure requirements. For example, Thallo’s Carbon Management Dashboard saves companies time and resources, allowing them to focus on their core business operations while ensuring adherence to the new regulations.

Providing accessible and transparent carbon credit data

A digital approach is also key to shifting away from the status quo – defined by PDFs, excels and paper-based documentation. Here, Thallo’s infrastructure provides comprehensive information about each carbon credit, which will be supplemented by third-party data providers over time. This empowers businesses to make informed purchasing decisions, confidently meet disclosure obligations, and build trust with customers, investors, and stakeholders.

Connecting buyers directly with sellers

Software empowers buyers to connect directly with sellers. Thallo’s software-based custody model means that we do not take inventory and therefore serve as a neutral, unbiased access point to carbon market supply. Pricing is transparent and directly determined by the sellers. What’s more, by making the platform completely free for project developers, we are empowering project owners in the global south who are too often shut out of global markets.

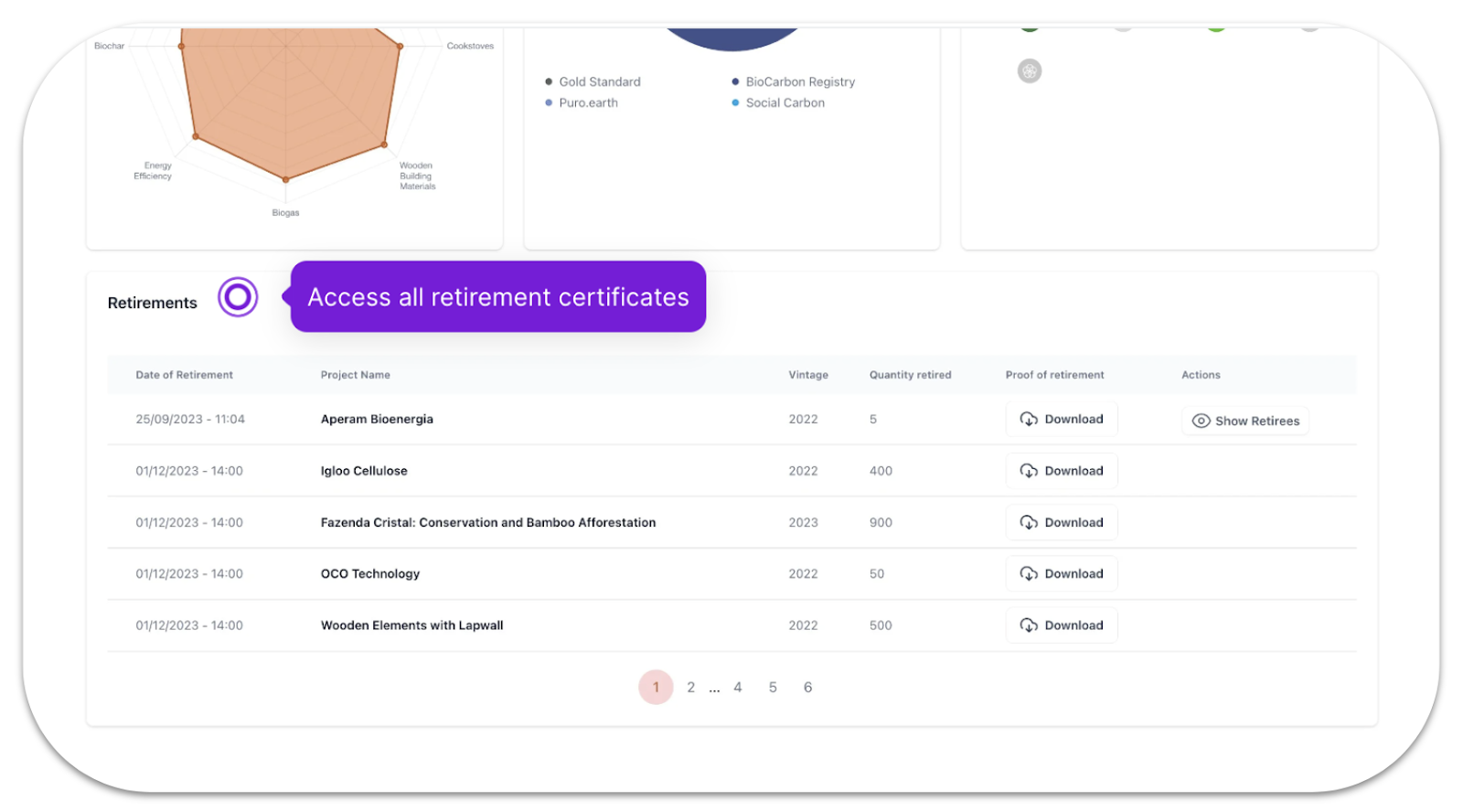

Ensuring end-to-end auditability

Cutting edge traceability is needed to support the underlying integrity of the market. At Thallo, every purchase—even one representing as little as a carbon gramme—will have a unique external ID. This ID is linked to a digital certificate non-fungible token (NFT) that represents the underlying certificate on blockchain. That, in turn, is linked to a retirement certificate issued by the underlying registry. This level of auditability – connecting every offset transaction to its original project – is unparalleled in the market.

Making all retirements public and traceable

When it comes to environmental claims, full transparency means that all issuances and retirements must be open, and publicly available for all to see. Thallo remains the only entity in the world able to tokenize live carbon credits from multiple ICROA-accredited registries. This means that every carbon credit listed and retired on our infrastructure has an open and public audit trail – available to all stakeholders. As more registries implement blockchain integrations, this type of transparency could become a must-have for all robust net zero claims.

The way forward from here

In summary, demand-side transparency is fundamental to generating trust and scale in the market. Although many things will be required to transform the market, a software driven approach can play a key role. Infrastructure like Thallo’s can provide some tools for demand-side customers to future-proof their carbon offsetting journeys. If you want to find out more, please reach out to one of our team.