Missed our live webinar on Corporate Buyer’s Guide to Carbon Credit Quality? No worries! Catch up on the recording and learn from our panel of experts on how to determine quality in carbon credits.

Should my company buy carbon credits?

Unlock the potential of carbon offsetting for your business! With so much conflicting information, non-standardized options, and lack of regulation, navigating the world of carbon offsetting can be overwhelming. But fear not, Thallo’s comprehensive guide will help your business overcome the challenges of buying carbon offsets, and integrate them into your sustainability strategy.

Companies often use carbon offsetting in order to build their sustainability brand reputation or to generate customers by marketing a product or service as ‘carbon neutral.’

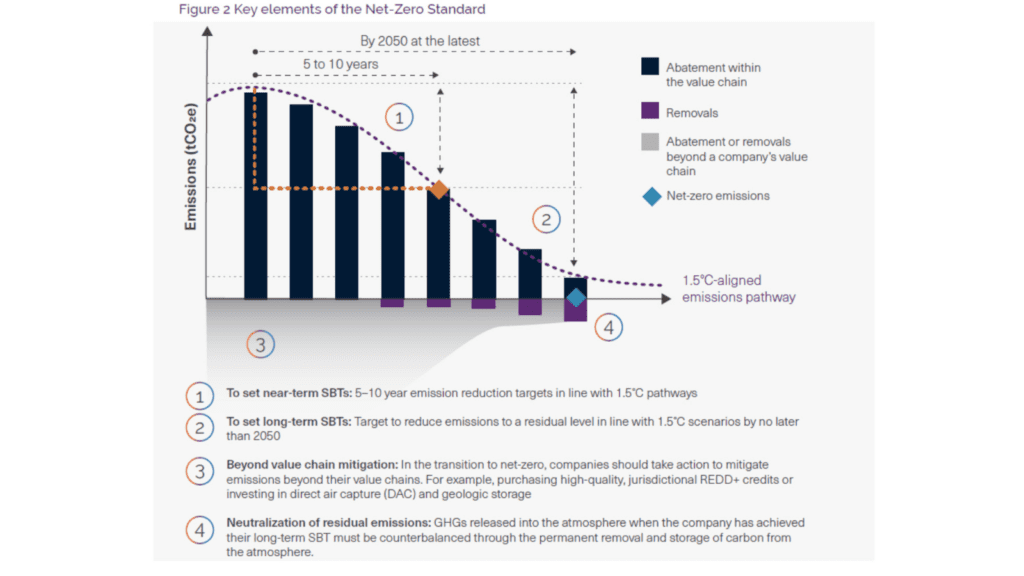

But remember, best practice and the mitigation hierarchy tells us that carbon offsets should not be used in place of decarbonization efforts. Carbon credits should only be used to offset residual emissions that can’t be avoided. Many companies also choose to purchase carbon credits as a complement to decarbonizing their own supply chain – called ‘beyond value chain mitigation.’

What is a high quality carbon credit / carbon offset?

A carbon offset is simply a carbon credit (representing one tonne of carbon) that has been used to compensate for emissions activities.

The Integrity Council for the Voluntary Carbon Market’s Core Carbon Principles, suggests 10 principles that define ‘high integrity’ carbon credits. The 4 principles that relate to the emissions impact are:

1. Additionality: carbon credits must represent emission reductions that would not have occurred in the absence of the carbon credit project.

2. Permanence / durability: Permanence refers to the duration of time carbon will be stored in natural or geologic sinks.

3. Robust quantification of emission reductions and removals: Accurate measurement and quantification based on conservative, complete and scientific-based methods.

4. No double counting: Credits should be counted only once toward achieving targets, avoiding double issuance, double claiming, or double use.

The remaining Core Carbon Principles apply to the crediting body that issued the carbon credits (often called ‘registries’), such as Verra, Gold Standard or Puro.earth, and to the sustainable development co-benefits of credits.

What carbon credits should my company buy?

Although each credit represents one tonne avoided or removed, there are many different methodologies, and there is no one right answer about which carbon offsets to buy. Guidance changes regularly, so someone on your team should remain abreast of current best practices. A good strategy is to mix and match, and think about a portfolio of carbon credits with different methodologies and varieties represented.

In a market where demand will increase and supply is uncertain, it is crucial to embrace uncertainty. Buyers should act now, and try to reserve long-term high quality carbon credit volumes, when they are still available.

Dimensions to consider include:

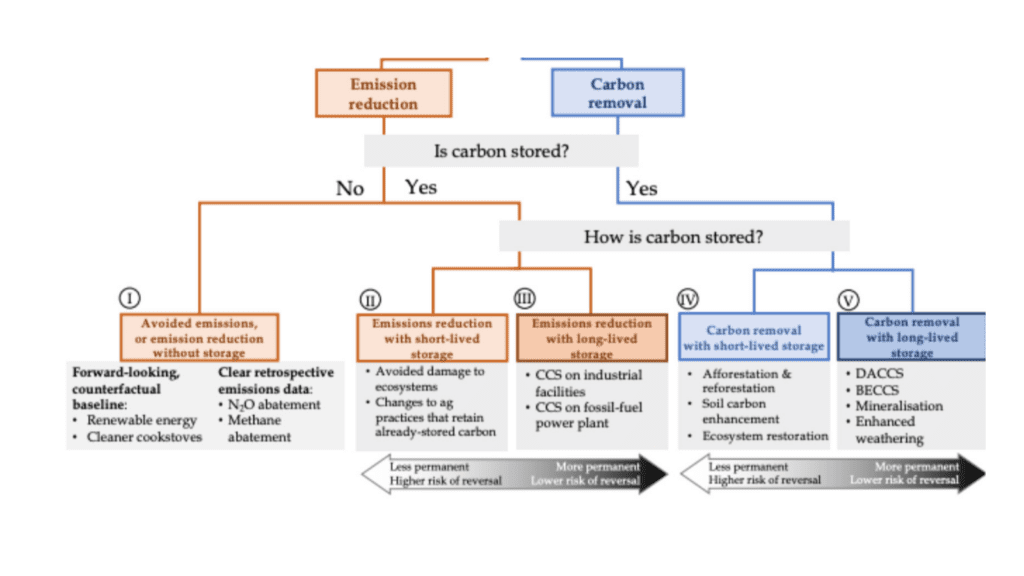

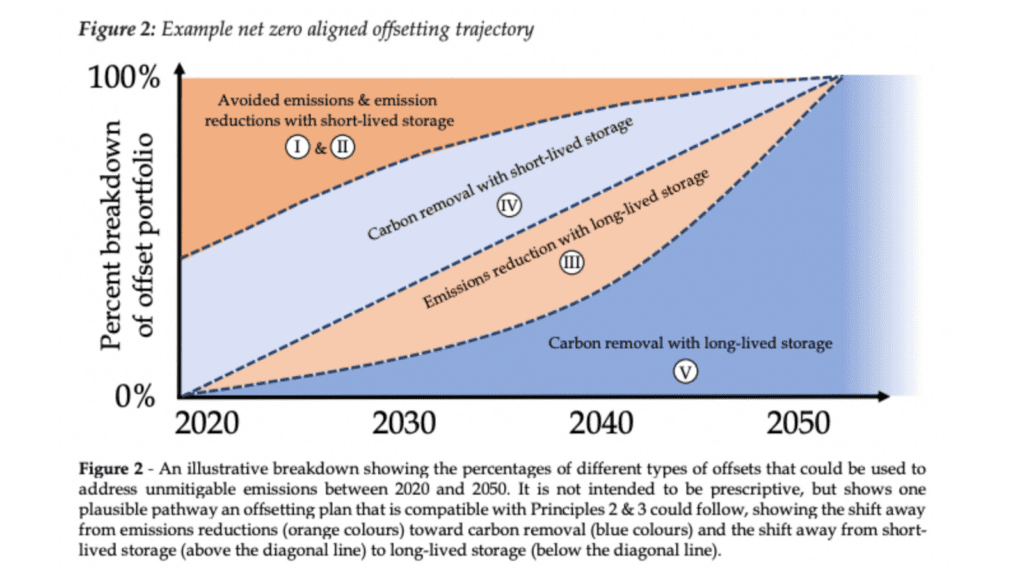

>Avoidance/reduction vs. removal credits

Avoidance or reduction credits lower the amount of emissions that would be released into the atmosphere as compared to a baseline scenario (e.g. avoiding deforestation). Removal credits pull carbon out of the atmosphere, and can be natural (e.g. tree-planting) or engineered (e.g. direct air capture).

Experts disagree about which is best to purchase. Some advocate for carbon removals, since the IPCC research shows humans will need to remove carbon – going beyond net zero – in order to reach the aims of the Paris Agreement.

Others champion avoidance and reduction credits, since they align with the mitigation hierarchy (essentially: minimizing negative impacts first, before compensating).

In general, carbon removals are less available and more expensive than avoidance credits. Many companies therefore opt for a mix of majority avoidance credits with a small percentage of removals credits mixed in.

>Nature-based (shorter-lived) vs. engineered (longer-lived) carbon removals

Nature-based carbon removal involves using natural ecosystems such as forests, wetlands, and soils to capture and store carbon. Engineered carbon removal uses technology such as direct air capture, and carbon capture and storage to remove carbon dioxide from the atmosphere.

Because nature-based removals are based on specific land use and environmental conditions, they are considered to have a higher risk of being reversed within decades.

Engineered carbon removals typically have less risk of reversal, and therefore longer durability. They do require signifiant energy inputs and infrastructure, however, are currently less scaleable.

>Geography or specific sustainable development goals

One of the main differentiators among carbon projects are the co-benefits or positive spill-over effects they have on the surrounding communities and environment. Beyond the quantified carbon avoided or removed, they allow the offsetting companies to tell an impact story aligned with the projects being financed.

If your company has particular ESG or CSR goals, you may wish to purchase carbon credits that align with those goals. For instance, you may want to choose carbon credits from a country where your company operates. Or you may want to look for credits with co-benefits tied to a particular sustainable development goal, like gender equality or clean water.

>Jurisdictional vs. non-jurisdictional credits

Relevant only for nature-based projects, jurisdictional credits are generated through large-scale programs aimed at reducing emissions across a region, often involving government support and regulation. They can be very slow to be developed, but once established with government buy-in, are hugely scaleable and impactful.

Non-jurisdictional credits are generated through individual projects or activities, and are delivered by an independent project developer. Therefore they are typically smaller scale projects, but more available, especially in countries with limited government commitment to climate action.

Step 1: Decide budget / timeframe

Assuming you have done your carbon accounting, set targets, and completed or planned decarbonization efforts within your supply chain, the first step is to decide the budget and timeframe you’re working within.

It is important to think about the next 3-5 years of carbon credit volume that you’ll need, so you should have an idea of your emissions during that time period.

Access to supply improves when you’re able to commit for multiple years. The price per credit also decreases when you buy higher volumes. Multi-year portfolios also secure the best prices in a complex and ever-evolving market.

However, many companies start with spot purchases, particularly if future company emissions are difficult to estimate, or long-term budgeting is infeasible.

Key Questions:

–What budget is available, now and in the future?

–Timeframe under consideration?

Step 2: Determine carbon credits to purchase

Using the details from the above section ‘What credits should my company buy?’, your company should establish a carbon offset strategy, and look for credits that will satisfy that strategy. Any credits you purchase, however, should satisfy the Core Carbon Principles’ ‘high integrity’ framework, including the credits themselves and the issuing body.

Key Questions:

–Does your company have preference / rationale for certain credit choices (see ‘What credits should my company buy,’ above’)?

Step 3: Decide where/how to buy the carbon credits

Buyers have three options to acquire carbon credits:

-Direct tendering with project developer: typically a lengthy, multi-month process, that requires its own due diligence on a per-project basis.

-Buying from resellers and brokers: this can be a good way to outsource the purchasing process, but brokers will often add a significant mark-up to the credits (Thallo research shows some 15% of credit value goes to these intermediaries). They also often only have access to a limited number of projects to select from

-Direct trade via data-enabled platform: Buying through platforms can be beneficial because it helps buyers and sellers by giving them a framework of terms and conditions. Platforms also enable portfolio management – facilitating the achievement of a company’s offsetting strategy. Data-enabled platforms can also help with reporting, traceability, portfolio management and ongoing monitoring

There are several types of purchase agreements:

–Spot purchases: one-time purchase of already-issued credits

–Long-term offtake: agreement to purchase credits when they are issued over a period of time

–Forward offtake commitment provides guaranteed revenue for project developers at an early stage and budget certainty for the buyer over a set amount of time

–Prepayment provides upfront capital needed for the project, and in return, the buyer organization receives carbon credits at a discount over time

–Equity investment is another (much less common) option, where an organization invests directly into a company or specific asset, providing access to carbon credits and a potential financial return

Key Questions:

-What is your company’s risk appetite?

–What is your current budget, and how will that change over time?

-How will you maximize impact and/ or climate financing?

–Where will you source the credits?

Step 4: Conduct due diligence

Given the lack of regulation in the voluntary carbon market, it is the buyer’s responsibility to conduct due diligence on their purchase. The section “What is a high quality carbon credit / carbon offset?” is a good starting point. Risks can be reputational, financial/market, operational/execution, and political/regulatory.

Carbon credit ratings agencies like Sylvera, BeZero, and Calyx, offer third-party assessments of quality for carbon credit projects. BeZero’s high-level ratings are available for free here.

The Carbon Credit Quality Initiative has a free methodology-based rating tool, which provides guidance as to the likelihood of the carbon credit actually avoiding or removing a tonne of carbon.

Key Questions:

–What risks might be associated with the carbon credit types you’ve chosen? (refer to pages 25-26)

Step 5: Communicate your strategy and publicly report and disclose in alignment with best practices

Make a public and transparent commitment to a science-based emissions reduction target, and report against that target.

Entities that are concerned with corporate best practices are the Science Based Targets Initiative (SBTi) and the Voluntary Carbon Market Integrity Initiative (VCMI).

SBTi recommends only using carbon removal credits to compensate for residual emissions – those that cannot be removed through other decarbonization efforts – and avoidance credits for ‘beyond value chain mitigation,’ or non-offset purposes. VCMI initiative has a provisional Claims Code of Practice to help corporates navigate how to talk about their purchases and avoid greenwashing.

Additional Resources:

- Oxford Principles for Net Zero Aligned Carbon Offsetting: Brief and academic guide with principles for carbon offsetting, including different types of carbon credits, and high-level recommendations for long-term carbon offsetting strategy.

- Shopify’s Buying Carbon Removal, Explained: Succinct buyer’s guide focused on carbon removals offers explainers and a step-by-step process to buy removal credits.

- WBCSD’s A Buyer’s Guide to Natural Climate Solutions Carbon Credits: This extremely detailed paper offers a rigorous framework for purchasing carbon credits from nature-based projects.

- Tropical Forest Credit Integrity Guide for Companies: Specific to tropical forest credits, this guide is an excellent resource that has applicability to other credit types.